However, there may be instances where adjustments need to be made due to various reasons, such as correcting an error or reflecting changes in employee benefits. Please note that adjusting payroll liabilities should be done with caution, as it can have a direct impact on your financial statements and tax reporting. It is recommended to consult with a professional bookkeeper or accountant if you are unsure about the adjustments you need to make. In this comprehensive guide, we will explore how to adjust payroll liabilities in QuickBooks, QuickBooks Online, and QuickBooks Desktop.

I have followed these instructions and these are still showing up in liabilities to be paid.

Step 3: Remit the payroll liabilities for the period

Adjusting payroll liabilities in QuickBooks Online allows you to correct any discrepancies and maintain accurate financial records. This process involves reviewing your payroll liabilities, identifying the adjustments required, making the necessary changes, and verifying the adjustments to ensure they are accurately reflected in your financial reports. This recalibration process involves meticulously reviewing each payroll tax and liability entry, correcting any discrepancies or errors, and ensuring that the withholding amounts and employer contributions are accurately reflected. Once identified, incorrect amounts are zeroed out through careful adjustments, which involve reconciling the adjusted figures with the company’s financial records. This recalibration process involves carefully reviewing the previous calculations, identifying any discrepancies or errors, and then correcting these figures to reflect the accurate tax withholdings and liabilities.

It is essential to review and verify the adjustments made to ensure accuracy in your financial records. You can generate payroll liability reports or review the individual liabilities in your Chart of Accounts to confirm that the adjustments have been applied correctly. Setting up payroll liabilities in QuickBooks Desktop involves configuring tax categories, defining payment schedules, and establishing employee contribution parameters to ensure accurate tracking and reporting of the company’s payroll obligations. Once you have reviewed and verified the adjustments, you can proceed with running financial reports, preparing tax filings, and utilizing the adjusted payroll liabilities for accurate financial analysis.

Steps to Adjust Overpaid Payroll Liabilities in the Company File

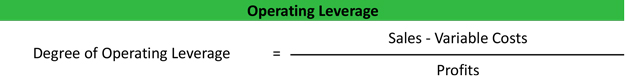

It is crucial to consider the implications of these changes, as they may affect employee pay, tax reporting, and overall financial management. Adjusting payroll liabilities in QuickBooks involves making changes to the recorded amounts of various payroll obligations and ensuring that the financial records accurately reflect the current liabilities and taxes owed. By diligently following these steps, you can what is profit measures of profit ensure that your payroll liabilities are accurately adjusted in QuickBooks Online. This will enable you to maintain accurate financial records, comply with tax regulations, and make informed decisions based on reliable payroll data.

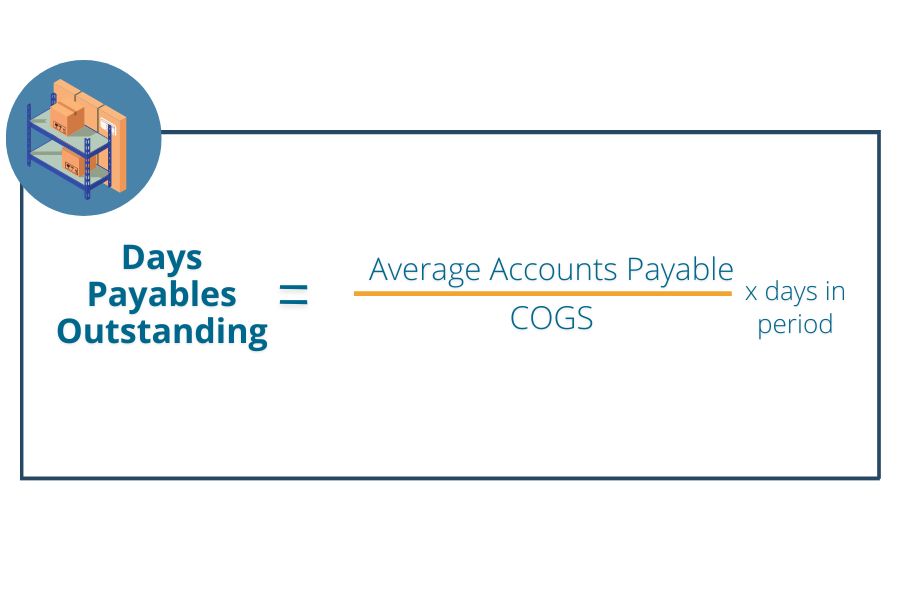

Most businesses must submit their last month’s payroll deductions to the Canada Revenue Agency (CRA) by the 15th of the current month. This will help you keep track of your payroll details financial leverage deals with and history, especially at year ends. Thank you for getting back to us and providing detailed information (with screenshots) regarding your payroll liabilities issue, @bbxrider.

By following either option, you will be able to make the necessary adjustments to your payroll liabilities in QuickBooks Online. These adjustments will ensure that your financial records accurately reflect the changes you need to make based on the review conducted earlier. Once inside the payroll setup, accountant for independent contractor it is important to review the tax categories to ensure they accurately reflect the current tax regulations and any applicable changes.

How to Set Up Payroll Liabilities in QuickBooks Desktop?

- By diligently following these steps, you can ensure that your payroll liabilities are accurately adjusted in QuickBooks Online.

- It is essential to review the adjustments made in the Chart of Accounts to confirm their accuracy.

- If you are an employer who has overpaid payroll tax liabilities using QuickBooks, then you might want to get the overpaid amount credited as your payroll tax liabilities and get this over payment adjusted in QuickBooks Company file.

- Once you have reviewed and verified the adjustments, you can proceed with running financial reports, preparing tax filings, and utilizing the adjusted payroll liabilities for accurate financial analysis.

Once the incorrect amounts are identified, the next step is to zero them out and reconcile the adjusted figures with the company’s financial records. This process involves carefully examining each employee’s pay rate, deductions, benefits, and any other relevant information to ensure that their records are updated with the correct information. Reconciling any discrepancies between the adjusted liabilities and the original records is essential to maintain accurate financial reporting. This process necessitates a thorough review of the current payroll settings to identify areas that require modification. For example, if there are changes in tax laws, the tax categories must be adjusted accordingly to ensure compliance. QuickBooks offers options to customize withholding rates based on the latest regulations, and it also allows flexibility in adjusting employer contributions.

Step 1: Identify the Need for Adjustment

For instance, if an employee’s vacation pay is adjusted retroactively, it would prompt a change in the accrued vacation liability. Similarly, if a new tax law is enacted, it may lead to adjustments in tax calculations and withholdings. Adjusting payroll liabilities in QuickBooks Online involves similar steps to the desktop version, with the added convenience of cloud-based accessibility and collaborative functionality for streamlining the adjustment process. Now that you have completed the review and verification process, you can rest assured that your payroll liabilities in QuickBooks Online are accurately adjusted, reflecting the changes you have made.

Recent Comments