A DOL higher or lower than industry standards can indicate areas for improvement or potential strengths. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Later on, the vast majority of expenses are going to be maintenance-related (i.e., replacements and minor updates) because the core infrastructure has already been set up.

Support Pricing Decisions

This structure provides stability, as lower fixed costs mean the company doesn’t require high sales volumes to cover its expenses. A corporation will have a maximum operating leverage ratio and make more money from each additional what is cash flow and why is it important for businesses sale if fixed costs are higher relative to variable costs. On the other side, a higher proportion of variable costs will lead to a low operating leverage ratio and a lower profit from each additional sale for the company.

Create a Free Account and Ask Any Financial Question

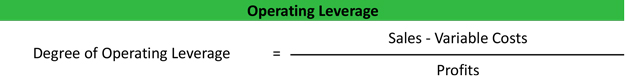

To calculate the degree of operating leverage, you will need to know the company’s sales, variable costs, and operating income. Companies with high fixed costs relative to variable costs will exhibit high operating leverage, meaning their earnings are more volatile with changes in sales. This can be beneficial in periods of rising sales but risky when sales decline. Typically, a high DOL means that the company has a larger portion of fixed costs in comparison with variable costs. In other words, any increase in sales might cause an increase in operating income.

How Can This Metric Help You Make Better Decisions?

The DOL indicates how sensitive your operating income is to changes in sales volume. One concept positively linked to operating leverage is capacity utilization, which is how much the company uses its resources to generate revenues. Increasing utilization infers increased production and sales; thus, variable costs should rise. If fixed costs remain the same, a firm will have high operating leverage while operating at a higher capacity. The degree of operating leverage can show you the impact of operating leverage on the firm’s earnings before interest and taxes (EBIT). Also, the DOL is important if you want to assess the effect of fixed costs and variable costs of the core operations of your business.

How to Calculate the Degree of Operating Leverage (DOL)?

The degree of operating leverage (DOL) is a multiple that measures how much the operating income of a company will change in response to a change in sales. Companies with a large proportion of fixed costs (or costs that don’t change with production) to variable costs (costs that change with production volume) have higher levels of operating leverage. The DOL ratio assists analysts in determining the impact of any change in sales on company earnings or profit.

The DOL calculator is one of many financial calculators used in bookkeeping and accounting, discover another at the links below. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- The management of XYZ Ltd. wants to calculate the current degree of operating leverage of its company.

- Other company costs are variable costs that are only incurred when sales occur.

- So, whether you’re a seasoned financial pro or a business owner looking to optimize profitability, keep this guide handy.

Degree of operating leverage can never be negative because it is a ratio of two positive numbers (sales and operating income). As such, the DOL ratio can be a useful tool in forecasting a company’s financial performance. Degree of operating leverage closely relates to the concept of financial leverage, which is a key driver of shareholder value. DOL can help any company to determine the suitable level of operating leverage.

Operating leverage measures a company’s fixed costs as a percentage of its total costs. It is used to evaluate a business’ breakeven point—which is where sales are high enough to pay for all costs, and the profit is zero. A company with high operating leverage has a large proportion of fixed costs—which means that a big increase in sales can lead to outsized changes in profits. A company with low operating leverage has a large proportion of variable costs—which means that it earns a smaller profit on each sale, but does not have to increase sales as much to cover its lower fixed costs.

Recent Comments