In summary, the average payment period serves as an indicator of how efficiently a company leverages its credit advantages to meet its short-term supply needs. The average payment period ratio can be calculated using the below-mentioned formula. There’s no one-size-fits-all number because it depends on the company’s payment policies, the industry standards, and the terms negotiated with suppliers. It can range from 30 to 90 days, but looking at specific company or industry data to get an accurate figure. Conversely, paying suppliers promptly can strengthen relationships and potentially secure better terms, but it may reduce working capital.

Example of the average payment period

Divide an amount calculated in step 1 (average payable) with the per-day sales calculated in step 2 (credit sales per day). The figure obtained is a valuable insight that helps to assess the average payment period of the business. The average payment period is a crucial solvency ratio for any company as it tracks the ability to settle amounts owed to suppliers. For investors and stakeholders, understanding someone claimed your child, dependent now what to do the average payment period is essential for making informed decisions and identifying potential investment opportunities. Also, calculating the average payment period provides valuable information about the company, including its cash flow position, creditworthiness, and more. This information is valuable for the company’s stakeholders, investors, and analysts, enabling them to make informed decisions.

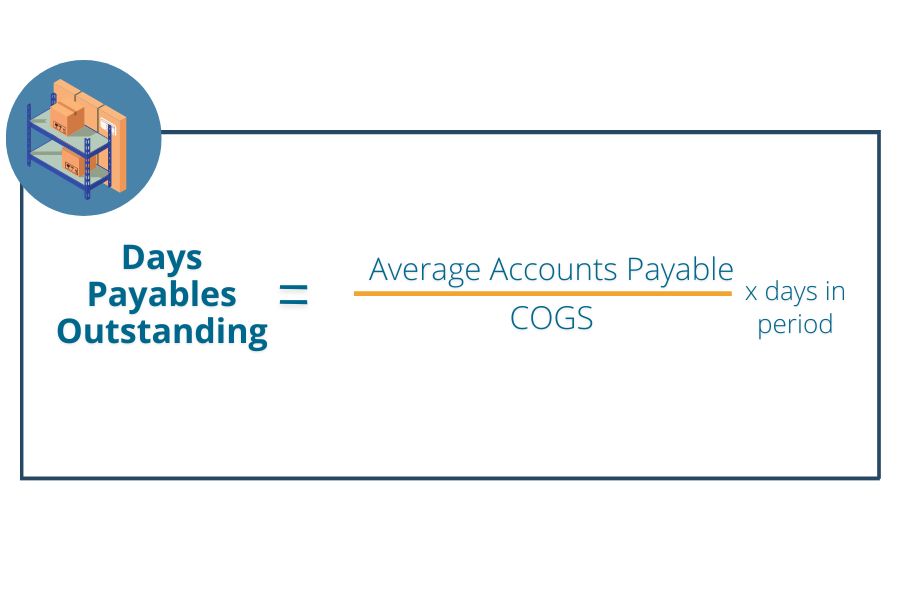

Formula for Days Payable Outstanding (DPO)

When a company’s DPO is high, this may either mean the company is struggling to pay bills on time or is effectively using credit terms. To manufacture a salable product, a company needs raw material, utilities, and other resources. In terms of accounting practices, the accounts payable represents how much money the company owes to its supplier(s) for purchases made on credit. Moreover, companies from the industry could have different average payable periods, because it also depends on the size of a company.

Download App

For instance, the average payment duration in the electronics/ICT industry is approximately 68 days, while in the steel/metals industry, it stands at about 45 days. Accounts payable are usually a short-term liability, and are listed on a company’s balance sheet. Accounts payable are usually due in 30 to 60 days, and companies are usually not charged interest on the balance if paid on time.

If a company only uses the cost of goods sold in the numerator, this creates an excessively high turnover ratio. Days Payable Outstanding, or DPO, is one of several metrics used to gauge the financial health of a company. In short, it measures about how many days it takes the company to pay its obligations.

- Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others.

- Continued evaluation is critical to staying productive and profitable in a constantly changing global marketplace.

- Our team of reviewers are established professionals with years of experience in areas of personal finance and climate.

- Determining where to improve efficiencies ensures timely payments and helps the organization save money.

Accounting Calculators

The average payment period is the time the business takes to pay off its creditors. Often, companies need to manage between qualitative and quantitative factors in terms of credit management. Clothing, Inc. is a clothing manufacturer that regularly purchases materials on credit from wholesale textile makers. The company has great sales forecasts, so the management team is trying to formulate a lean plan to retain the most profit from sales. One decision they need to make is to determine if it’s better for the company to extend purchases over the longest available credit terms or to pay as soon as possible at a lower rate.

The average payment period is the measure of days the business takes to pay off accounts payable. It’s a solvency ratio and indicates business practice to satisfy obligations that fall due. The length of the average payment period is dependent on multiple factors including business policies, liquidity, adequacy of financial planning, and pattern of negotiation with the suppliers. All of these decisions are relative to the industry and company’s needs, but it is apparent that the average payment period is a key measurement in evaluating the company’s cash flow management.

It represents a critical part of the average payment period, and managing DSO effectively can significantly enhance your overall payment cycle. It’s essential to identify specific metrics impacting DSO, like the number of past-due invoices or unapproved discounts, to allow proactive rectification and mitigation. Calculating the Average Payment Period involves dividing the accounts payable balance by the total cost of sales, and then multiplying the result by the number of days in the period considered (often a year). This calculation brings out the actual days it takes for the company to pay its bills. You can calculate the remaining components of the APP formula once you know the average accounts payable.

A good average payment period is one that aligns with the industry average or that of comparable companies. Ensuring timely collections enables timely payments, creating a positive cycle of financial efficiency. Thus, it would make more than 10% on its money reinvesting in new inventory sooner. However, excessive delays can harm supplier relationships and lead to missed discounts. DPO and DSO are key components of the Cash Conversion Cycle (CCC), which tracks how long it takes for a company to convert its investments in inventory and other resources into cash. Conversely, a low one suggests that customers are paying quickly, enhancing cashflow.

Therefore, investors, analysts, creditors and the business management team should all find this information useful. Since APP is a solvency ratio it helps the business to assess its ability to carry business in the long-term by measuring the ability of the company to meet its obligations. Also since it helps the business know when to pay vendors it can help the company in making cash flow decisions. Something that is very important to consider when beginning to calculate the average payment period for a company is the number of days within a period. However, you have to try and strike a balance as taking as long as possible to pay creditors can result in the company having more money which is good for working capital and available cash flows. The Average Payment Period represents the approximate number of days it takes a company to fulfill its unmet payment obligations to its suppliers or vendors.

Recent Comments